TrustTexas Bank COVID-19 Statement as of 10/13/2020

As we all try to navigate the challenges of the COVID-19 pandemic, we want to make sure our customers know that TrustTexas Bank is here when you need us.

ATM’s and Digital Banking Services are always available 24 hours a day. We are encouraging customers to use our digital banking services, our mobile banking app, our 24 hour telephone banking system at 1-866-906-2265, ATM’s and drive thru services to help minimize one-on-one contact. If you have not enrolled in digital banking, please click here or download our mobile banking app and follow the enrollment instructions.

If you have any questions, please give our customer service center a call at 1-800-342-0679, or send us an email at geninfo@TrustTexas.Bank. We are continually monitoring the latest information and implementing additional precautions as we comply with all governmental health and safety recommendations throughout this public health crisis. We are committed to providing professional service as we have a business continuity strategy in place to ensure business continues without interruption. Thank you for your continued loyalty to TrustTexas Bank. We look forward to getting through this together and serving you for years to come.

*Please check back this page or our Facebook page frequently for updates.

Prevention Tips:

- Wash hands with soap and water for at least 20 seconds several times a day, including between your fingers and underneath your nails. Handwashing is considered the best way to remove germs and dirt, and hand sanitizers should be used only when handwashing is not available. The hand sanitizers should be at least 60% alcohol to be effective.

- Practice social distancing - avoiding crowded places and maintaining distance from others

- Avoid contact with sick people

- Avoid touching your face – especially your eyes, nose, and mouth

- Stay home when you feel sick

- Cover your coughs and sneezes with a tissue then put the tissue in the trash, or use the crook of your elbow if a tissue isn’t available

- Clean and disinfect frequently touched objects and surfaces using a regular household disinfectant cleaning spray or wipe. Clean cell and desk phones, computer keyboards, door handles, and work surfaces often.

- Face masks are not considered an effective way to prevent someone from catching a virus unless you have close, frequent contact with a sick person; however, they are an option for sick people to use to keep from spreading the virus.

- Avoid travel to areas that have been designated high-risk areas because of multiple verified cases of Coronavirus

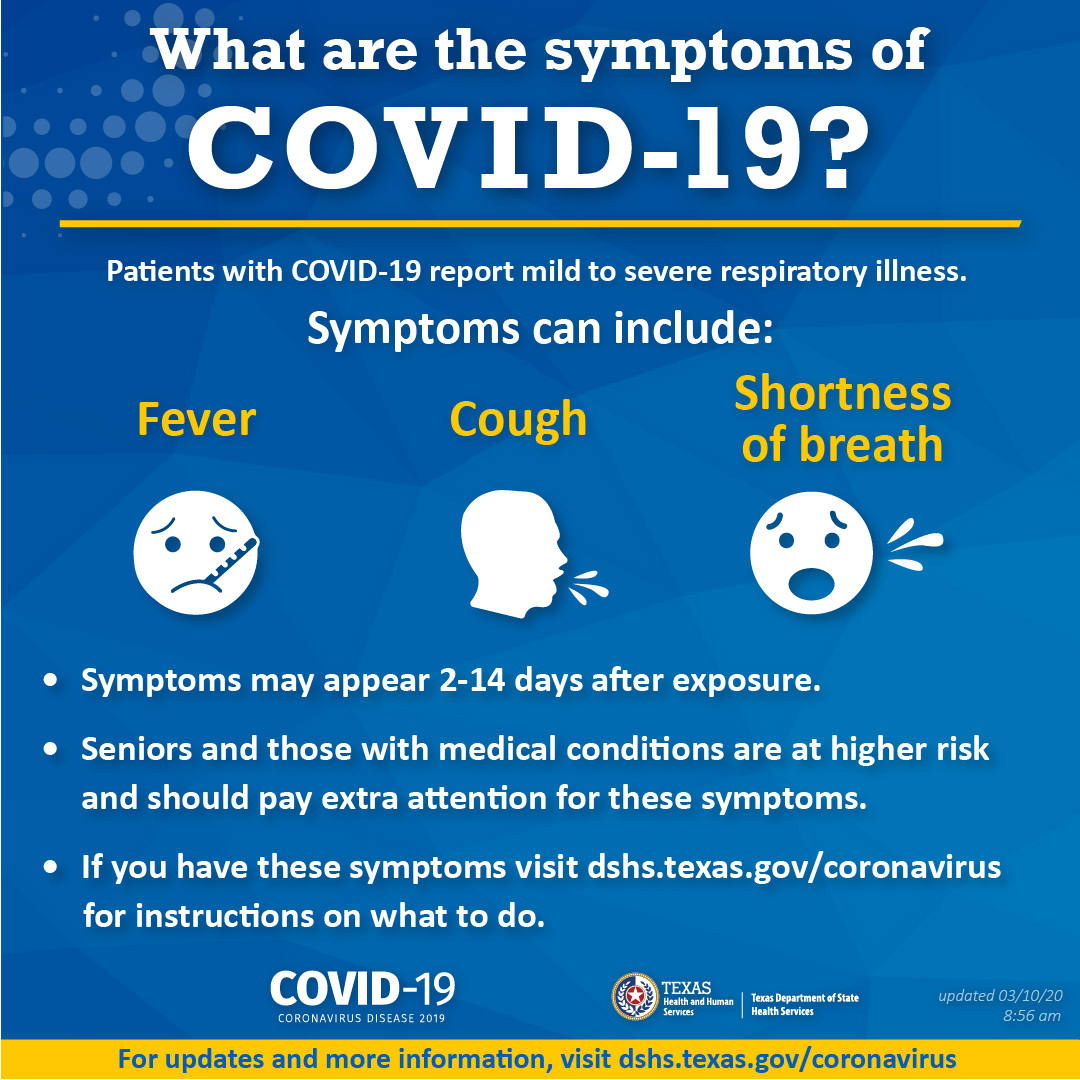

What are the symptoms of COVID‑19?

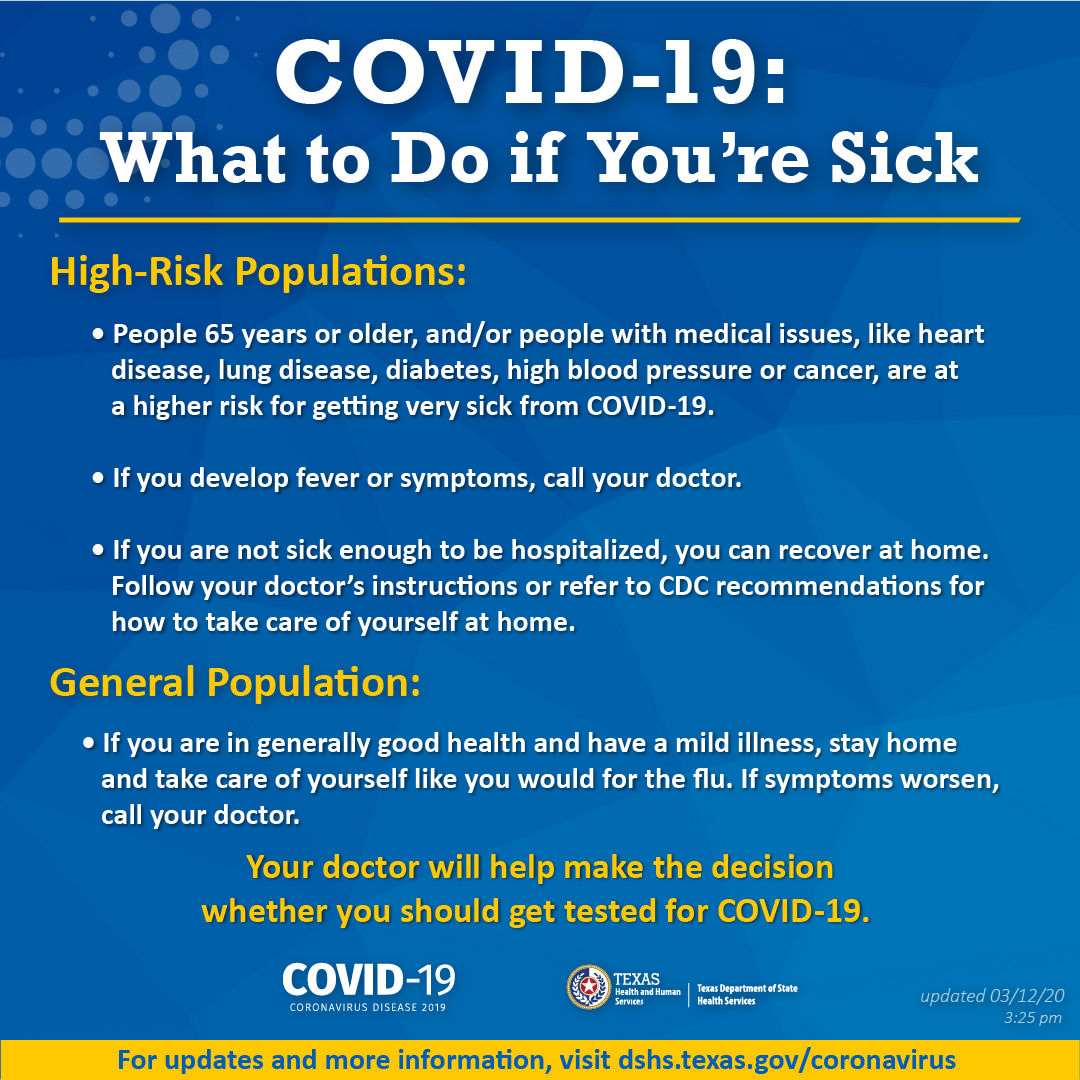

What to Do if You're Sick:

For more FAQs, visit the Texas Department of State Health Services (DSHS) website or the CDC's website.

Avoiding COVID-19 Scams

Unfortunately, scammers are finding ways to take advantage of the Coronavirus public health issue. We encourage you to be alert and aware of any requests from individuals or companies who may appear to be promoting awareness and prevention as a ruse to take your money and get your personal information. Here are some helpful tips from the Federal Trade Commission (FTC) to help you protect yourself:

- Don’t respond to calls, texts and emails about checks from the government. Learn more about the various scams related to checks from the government by clicking here.

- Don't click on links from sources you don't know. Scammers use email or text messages to trick you into giving them your personal information. They may try to steal your passwords, account numbers, or Social Security numbers. If they get that information, they could gain access to your email, bank, or other accounts. Verify the sender before clicking on any links. They could download viruses onto your computer or device. Make sure the anti-malware and anti-virus software on your computer is up to date.

- Be wary of emails claiming to be from the Centers for Disease Control and Prevention (CDC) or experts saying that have information about the virus. For the most up-to-date information about the Coronavirus, visit the Texas Department of State Health Services (DSHS), Centers for Disease Control and Prevention (CDC), and the World Health Organization (WHO) websites.

- Ignore online offers for vaccinations. If you see ads touting prevention, treatment, or cure claims for the Coronavirus, ask yourself: if there’s been a medical breakthrough, would you be hearing about it for the first time through an ad or sales pitch?

- Do your homework when it comes to donations, whether through charities or crowdfunding sites. Don’t let anyone rush you into making a donation. If someone wants donations in cash, by gift card, or by wiring money, don’t do it.

- Be alert to “investment opportunities.” The U.S. Securities and Exchange Commission (SEC) is warning people about online promotions, including on social media, claiming that the products or services of publicly-traded companies can prevent, detect, or cure coronavirus and that the stock of these companies will dramatically increase in value as a result.

Visit the FTC's website for more information on Coronavirus scams:

Coronavirus Scams: What the FTC is doing

Coronavirus Scams, Part 2

Information Regarding Stimulus Checks

Economic Stimulus Checks Are Coming For Millions Of Americans

Millions of adults in the United States will automatically be receiving a payment of up to $1,200 as part of the federal economic relief plan to soften the blow from the coronavirus pandemic. The goal for delivery of the money is sometime in April.

Eligibility will be based on reported income from your 2019 tax return if you have already filed, or your 2018 return if you have not filed for 2019. To be eligible, you also must have a Social Security number.

The stimulus money will be directly deposited into your bank account if the IRS already has that information from your tax return, otherwise a check will be mailed to you. If you receive your check by mail, a fast way to get it into your account will be to use mobile deposit via your financial institution’s mobile banking app.

Here are some highlights of the plan:

- Individuals with annual adjusted gross incomes of $75,000 or less will receive $1,200.

- Married couples will get $2,400 if their income is under $150,000.

- Families will also get an extra $500 per child 16 and younger.

- The amounts people receive will be reduced on a sliding scale for individuals making up to $99,000 and married couples up to $198,000.

- Those who filed as heads of household and earn up to $112,500 a year will get $1,200 and $500 per child. The amount those adults receive will decline on a sliding scale to those earning up to $136,500.

- Those receiving Social Security benefits will receive the payments as long as their income does not exceed the limits. If you didn’t need to file a tax return, the information from form SSA-1099 will be used to send the money.

- For the millions of low-income citizens who aren't required to file a tax return, the IRS has added a button labeled ‘Non-Filers: Enter Payment Info Here' to its IRS.gov website. This link allows people to include their mailing address, information about a spouse or children, their Social Security numbers, and their financial account routing number so the money can be deposited directly. If they don't have an account, a check will be mailed to their address.

- In general, the stimulus checks will not be taxable, although there could be some exceptions.

The following information is from the IRS:

https://www.irs.gov/coronavirus/economic-impact-payment-information-center

and https://www.irs.gov/coronavirus/economic-impact-payments

How much is it worth?

Eligible individuals with adjusted gross income up to $75,000 for single filers, $112,500 for head of household filers and $150,000 for married filing jointly are eligible for the full $1,200 for individuals and $2,400 married filing jointly. In addition, they are eligible for an additional $500 per qualifying child.

For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$112,500/$150,000 thresholds. Single filers with income exceeding $99,000, $136,500 for head of household filers and $198,000 for joint filers with no children are not eligible and will not receive payments.

Who is eligible?

U.S. residents will receive the Economic Impact Payment of $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have a work eligible Social Security number with adjusted gross income up to:

- $75,000 for individuals

- $112,500 for head of household filers and

- $150,000 for married couples filing joint returns

Taxpayers will receive a reduced payment if their AGI is between:

- $75,000 and $99,000 if their filing status was single or married filing separately

- $112,500 and $136,500 for head of household

- $150,000 and $198,000 if their filing status was married filing jointly

Eligible retirees and recipients of Social Security, Railroad Retirement, disability or veterans' benefits as well as taxpayers who do not make enough money to normally have to file a tax return will receive a payment. This also includes those who have no income, as well as those whose income comes entirely from certain benefit programs, such as Supplemental Security Income benefits.

Retirees who receive either Social Security retirement or Railroad Retirement benefits will also receive payments automatically.

Who is not eligible?

Although some filers, such as high-income filers, will not qualify for an Economic Impact Payment, most will.

Taxpayers likely won't qualify for an Economic Impact Payment if any of the following apply:

- Your adjusted gross income is greater than

- $99,000 if your filing status was single or married filing separately

- $136,500 for head of household

- $198,000 if your filing status was married filing jointly

- You can be claimed as a dependent on someone else’s return. For example, this would include a child, student or older dependent who can be claimed on a parent’s return.

- You do not have a valid Social Security number.

- You are a nonresident alien.

- You filed Form 1040-NR or Form 1040NR-EZ, Form 1040-PR or Form 1040-SS for 2019.

Do I need to take action?

- People who filed a tax return for 2019 or 2018

No additional action is needed by taxpayers who:

- have already filed their tax returns this year for 2019. The IRS will use this information to calculate the payment amount.

- haven’t filed yet for 2019 but filed a 2018 federal tax return. For these taxpayers the IRS will use their information from 2018 tax filings to make the Economic Impact Payment calculations.

- People who aren't typically required to file a tax return

Social Security and Railroad Retirement recipients who are not typically required to file a tax return need to take no action. The IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate Economic Impact Payments of $1,200 to these individuals even if they did not file tax returns in 2018 or 2019. Recipients will receive these payments as a direct deposit or by paper check, just as they would normally receive their benefits. Social Security Disability Insurance (SSDI) recipients are also part of this group who don't need to take action.

For Social Security, Railroad retirees and SSDI who have qualifying children, they can take an additional step to receive $500 per qualifying child.

- New feature from the IRS

The US Treasury has developed a portal to check your payment status, confirm your payment type, and to enter or update your bank account information and mailing address.

- If the IRS doesn't have your direct deposit information from your 2018 or 2019 return – and they haven’t yet sent your payment – use the Get My Payment application to let them know where to send your direct deposit.

- If you don’t file taxes, use the "Non-Filers: Enter Your Payment Info Here" application to provide simple information so you can get your payment.

You should use this application if:

- You did not file a 2018 or 2019 federal income tax return because your gross income was under $12,200 ($24,400 for married couples). This includes people who had no income. Or

- You weren’t required to file a 2018 or 2019 federal income tax return for other reasons

- If you receive these benefits, we already have your information and you will receive $1,200. Do not use this application if you receive:

- Social Security retirement, disability (SSDI), or survivor benefits

- Railroad Retirement and Survivor Benefits

Special note: People in these groups who have qualifying children under age 17 can use this application to claim the $500 payment per child.

Watch for an IRS letter

For security reasons, the IRS plans to mail a letter about the economic impact payment to the taxpayer’s last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If a taxpayer is unsure they’re receiving a legitimate letter, the IRS urges taxpayers to visit IRS.gov first to protect against scam artists.

For more information and to access the payment portal, visit the IRS website below:

IRS Economic Impact Payments

COVID-19 Stimulus Relief Check Scams

Ready for your stimulus checks? Scammers are too. Here are important tips you should know on how to stay safe from scams and scammers with the recent approval of stimulus checks during COVID-19.

- No Action Is Needed By You - The IRS has stated that the vast majority of people do not need to take any action. The U.S. Government will not ask you to pay any sort of fee or charge to receive payment.

- There Is Nothing To Sign Up For - Anyone calling to ask for your personal information, like your Social Security number, PayPal account, or bank information is a scammer. Hang up on these calls! Ignore or delete it if you get a pop-up message, email or text that direct you to call a certain number or visit a website to verify personal information.

- Phishing Scams - Be on the lookout for email phishing scams. Some scammers will pretend to be from the government. When in doubt, you should initiate contact through a known telephone number or website.

- How To Receive Your Check Should Only Be Communicated With The IRS - Nowhere else, and never in response to an email, text, or phone call.

- There Is No Early Access To Checks - Some scammers will tell you that you qualify for early access to a check - this is not real. The U.S. Government will not offer to expedite your payment for a fee. Never give out your personal information.

For more information, visit the IRS's page on Economic Impact Payments and the FTC's page on stimulus check scams below:

FTC: Checks from Government

IRS Economic Impact Payments: What you need to know

Visit our Security Center for more tips and information:

TrustTexas Bank's Fraud Prevention Center

TrustTexas Bank's Security Alerts & Scams Center

|